Tokenomic Future: Insight from Ripple (XRP)

In recent years, the cryptocurrency world has increased significantly in adoption and innovation. This revolution is a critical aspect of Tokenomic, a blockchain technology that regulates the creation, distribution and trade of tokens. In this article, we immersed in the concept of Tokenomy, its importance in the cryptocurrency and the perspective of the pulsation (XRP) in the developing zone.

What is Tokenomy?

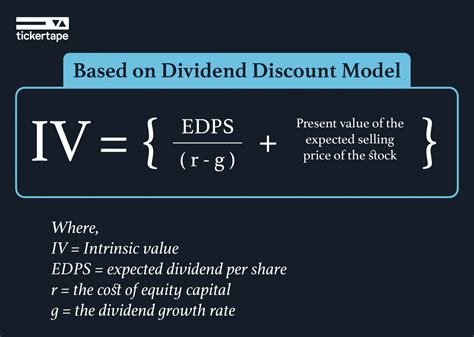

Tokenomics refer to the economic research of the markers, including the design and implementation of tokens. This includes a variety of aspects, such as the creation, distribution, trade and use of a marker. Tokenomy plays an important role in understanding how tokens communicate with their ecosystems, promotes confidence, security and the value of investors.

Meaning of Tokenomy in cryptocurrency

Cryptocurrencies such as Bitcoin, Ethereum and others have shown significant growth over the years, mostly increasing adoption and innovation in society. However, as cryptocurrency continues to expand its availability, Tokenomy has become a critical factor to ensure the long -term success and sustainability of these devices.

Tokenomy promotes a more efficient, transparent and customizable blockchain network. By understanding, distributing and providing tokens, developers can develop more efficient management models, promote participation and ensure the security and integrity of their networks.

Ripple (XRP) Perspective on Tokenomy

In 2018, Ripple announced its intention to interfere with the traditional marking process with the XRP marker. As a pioneer of blockchain -based payment systems, Ripple played a role in developing the concept of Tokenomics.

According to Ripple’s CEO, Brad Garlinghouse: «Tokenomics is associated with building an ecosystem that makes sense for business and people.» In this context, Tokenomy is associated with different aspects such as:

- Offer and Request

: Understand (delivery) and have access to chips (delivery).

- Do not commit : stimulus design for users to participate in a network such as transaction fees or consideration.

3

Management : Creating a management system that provides a decision -making authority among stakeholders.

- Security : Introduce stable security measures to protect against malicious activities.

Keep the main insight into Ripple (XRP) XRP Tokenomics

Ripple XRP -Tokenomics provides valuable insight into the possible benefits and challenges of cryptocurrency labeling:

1

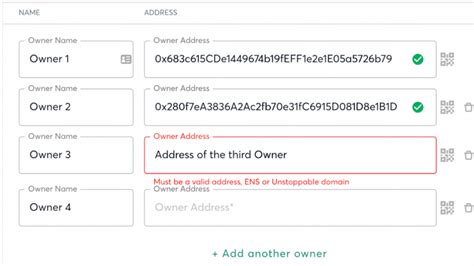

Decentralized Management : Denples decentralized management model allows users to participate in decision -making using a unique voting system.

- Effective transaction processing

: XRP -distributed ledger technology allows you to process quick and secure transactions by reducing the need for centralized replacement.

3

Low fees : Ripple local currency (XRP) rather than traditional Fiat currency use facilitates effective transactions with lower fees.

- Scalability : Ripple’s Tokenomics, focusing on the scalability, allowed e-commerce to be widely accepted in different sectors.

Conclusion

Tokenomy is a critical aspect of cryptocurrency that allows for safe, transparent and effective blockchain networks. Ripple (XRP) Tokenomy’s perspective provides a valuable insight into the possible benefits and challenges of cryptocurrency tokenization. As the world of cryptocurrency develops further, it is important for developers, investors and users to understand the complexity of Tokenomy.

suggestions

If you are interested in exploring the world of Tokenomics:

1.