«Crypto Madness: How BONK and FLOW are Changing the Payment Game»

As the world becomes increasingly digital, the need for secure and efficient payment systems is on the rise. Two new players in the crypto space are poised to disrupt the traditional payment landscape with innovative solutions that promise faster, cheaper, and more seamless transactions. In this article, we’ll dive into the world of cryptocurrency, explore two popular blockchain-based payment platforms, Bonk and Flow, and examine their unique features.

Bonk: A Cryptocurrency Payment Gateway

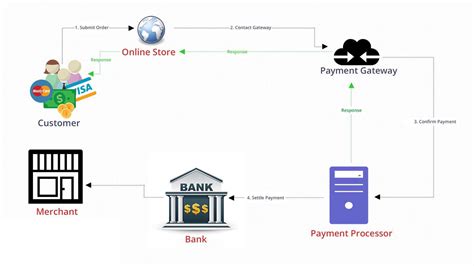

Founded in 2017 by Jason Fung, an experienced developer and entrepreneur, Bonk aims to provide a fast, secure, and user-friendly platform for cryptocurrency transactions. One of Bonk’s key strengths is its emphasis on decentralization and transparency. Unlike traditional payment gateways that rely on intermediaries like banks or payment processors, Bonk operates without any centralized authority or middlemen.

Bonk’s technology allows users to send and receive cryptocurrencies with a simple one-click process. The platform supports over 100 cryptocurrencies, making it accessible to a large user base worldwide. Bonk’s wallet app is also available for mobile devices, allowing users to manage their digital assets on the go.

Flow: A Blockchain-Based Payment Network

Launched in 2017 by Vitalik Buterin, co-founder of Ethereum, Flow represents an alternative approach to traditional payment systems. Flow operates as a decentralized network that enables fast and secure transactions without the need for intermediaries or centralized authorities.

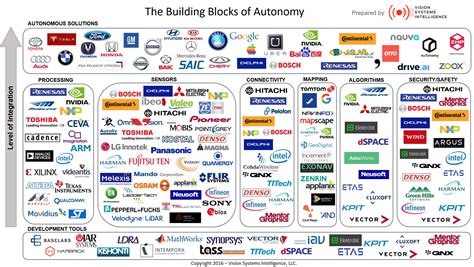

Flow’s architecture is built on a new consensus mechanism called the “Polkadot Network,” which allows it to connect different blockchains and enable seamless communication between them. This makes Flow an attractive option for businesses that require flexibility and scalability in their payment systems.

One of Flow’s key advantages is its low transaction fees, making it an attractive choice for merchants looking to process large volumes of transactions at a fraction of the cost of traditional payment processors. In addition, Flow’s support for multiple blockchains enables integration with different ecosystems, giving users greater flexibility and control over their digital assets.

Comparison and Conclusion

Bond and Flow are both making significant strides in the world of cryptocurrency payments, offering innovative solutions that promise faster, cheaper, and more seamless transactions. While both platforms share some similarities, they also have distinct differences that set them apart from traditional payment gateways.

Bonk’s focus on decentralization and transparency makes it an attractive option for users who value the autonomy of their digital assets. Flow, on the other hand, offers a more scalable and flexible solution for businesses looking to process large volumes of transactions at a fraction of the cost of traditional payment processors.

As the crypto space continues to evolve, we can expect to see even more innovative solutions emerge that address new challenges and opportunities in payment systems. Whether you’re a seasoned investor or just starting out, understanding the world of cryptocurrency payments is essential to making informed decisions about your digital assets.

![Ethereum: do I need to hold ETH (for tokens) in my wallet to receive ERC-20 with value? [duplicate]](https://abrazandoemociones.com/wp-content/uploads/2025/02/0eff5220.png)