AI and Blockchain: A Comprehensive Approach to Cybersecurity

The world of cybersecurity is rapidly evolving and the threat landscape is increasingly complex. As a result, it is essential to understand how artificial intelligence (AI) and blockchain can be leveraged to strengthen cybersecurity. In this article, we will explore the benefits of combining AI and Blockchain in cybersecurity.

Understanding AI in Cybersecurity

Artificial intelligence refers to the development of computer systems that can perform tasks that would typically require human intelligence, such as learning, problem-solving, and decision-making. In the context of cybersecurity, AI can be used to detect and prevent cyber threats in a variety of ways:

- Anomaly Detection: AI-powered systems can analyze patterns in network traffic and identify potential security breaches by detecting unusual activity.

- Predictive Analytics: Artificial intelligence algorithms can analyze historical data to predict the likelihood of a cyberattack, enabling proactive mitigation measures.

- Automated Response

: AI-powered systems can respond quickly to security incidents, reducing downtime and minimizing the impact on business operations.

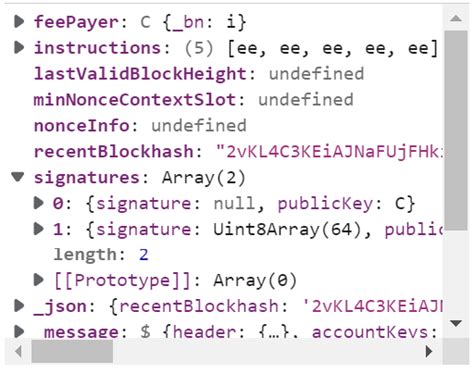

Blockchain in Cybersecurity

Blockchain technology is a distributed ledger system that enables secure, transparent and tamper-proof data storage. In cybersecurity, blockchain can be used to improve several aspects:

- Secure Data Storage: Blockchain-based systems can securely store sensitive information and protect it from unauthorized access.

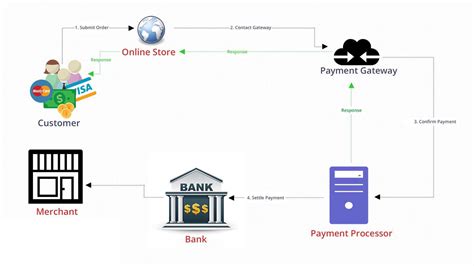

- Smart Contracts: Blockchain-based smart contracts can automate security-related processes such as payment processing or identity verification.

- Decentralized Identity: Blockchain-based identity management systems can provide a secure and decentralized way to identify individuals.

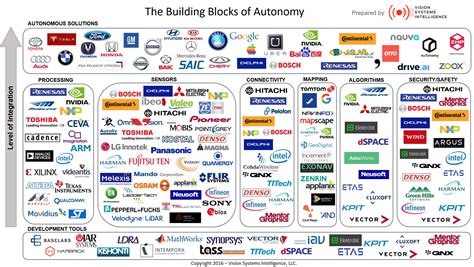

Benefits of Combining AI and Blockchain in Cybersecurity

The combination of AI and blockchain offers several benefits:

- Improved Security Posture: By leveraging the strengths of both technologies, organizations can strengthen their cybersecurity posture, reducing the risk of cyberattacks.

- Improved Incident Response: AI-powered systems can analyze large amounts of data to identify potential security breaches, while blockchain-based smart contracts can automate response processes.

- Increased Transparency: Blockchain-based systems provide a transparent, tamper-proof record of all transactions, increasing trust in an organization’s cybersecurity practices.

Real-World Examples

Several organizations have successfully integrated AI and Blockchain into their cybersecurity strategies:

- IBM Watson

: IBM Watson is a cloud-based AI platform that leverages blockchain to improve security posture.

- Microsoft Azure: Microsoft Azure provides a blockchain-based identity management system for securely storing data.

- Chainalysis: Chainalysis is a blockchain-based analytics firm used by cryptocurrency exchanges and other organizations to detect and prevent illicit activity.

Challenges and Limitations

While the benefits of combining AI and Blockchain in cybersecurity are clear, there are also challenges and limitations to consider:

- Regulatory Frameworks: The regulatory landscape for AI-powered security solutions is still evolving, and blockchain-based systems may face specific regulatory hurdles.

- Interoperability: Integrating AI and Blockchain technologies can be challenging due to differences in data formats and standards.

- Security Risks: As with any technology, there are potential security risks associated with the combination of AI and Blockchain in cybersecurity.

Conclusion

The integration of artificial intelligence and blockchain offers an effective approach to strengthening cybersecurity.

![Ethereum: do I need to hold ETH (for tokens) in my wallet to receive ERC-20 with value? [duplicate]](https://abrazandoemociones.com/wp-content/uploads/2025/02/0eff5220.png)