Here is an article on how to automate buying and selling on TradingView.com using Binance and the UT Bot Alerts indicator:

Title: TradingView Automation: How to Trade BTC/USD (BTCUSDT) with Binance and the UT Bot Alerts indicator

Introduction

Looking for a reliable way to automate your trading strategies on TradingView.com? With Binance as your exchange provider, you can now harness the power of automated trading bots to place trades based on pre-defined indicators. In this article, we will show you how to set up an automated trading bot using the UT Bot Alerts indicator and trade BTC/USD (BTCUSDT) on Binance.

Getting Started

Before you begin, make sure you have:

- A TradingView account on your Binance exchange provider account.

- A Binance API key or token.

- UT Bot Alerts indicator uploaded to your TradingView account.

Step 1: Create a new indicator file

To create a new indicator file for the UT Bot Alerts indicator, follow these steps:

- Log in to your TradingView account and go to the Indicators tab.

- Click the “+” button to upload a new file or edit an existing one.

- Name the file (e.g. “ut_bot_alerts_indicators.json”).

- Upload the indicator code and settings.

Step 2: Configure the indicator settings

In the uploaded file, you will need to configure the following settings:

- Indicator Type: Select “EA” (Exponential Moving Average) as the indicator type.

- Short Period: Set a short period value that matches your trading strategy (e.g. 14, 21, or 50).

- Long Period: Set the long period value to match your trading strategy’s risk management levels (e.g. 1, 5, or 30).

- SMA Length

: Adjust the SMA length to match your trading strategy’s requirements.

- EMA Multiplier: Set the EMA multiplier to control the strength of the indicator’s signals.

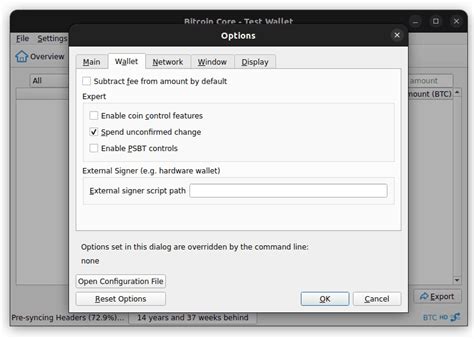

Step 3: Connect the Binance API

To automate trades based on the UT Bot Alerts indicator, you will need to connect your Binance account to their API.

- Log in to your TradingView account and go to the “API” tab.

- Click the “Binance API” button.

- Create a new API key or use an existing one.

- Save the API key as a private or public key.

Step 4: Set Up Automated Trades

Once the indicator is loaded and configured, you can now set up automated trades based on the UT Bot Alerts indicator.

- Log in to your TradingView account and go to the “Indicators” tab.

- Click on the “UT Bot Alerts” icon in the top right corner of the screen.

- Click on the “Settings” button (three dots) next to the indicator name.

- Scroll down to the “Automated Trades” section.

- Set the following settings:

- Trigger

: Select “Alerts” as the trigger.

- Condition: Select a condition that triggers the automated trade (e.g. a specific price level or percentage change).

- Target Price: Enter a target trade price.

- Take Profit: Set a take profit price (optional).

- Save your settings.

Step 5: Execute your trades

After setting up your automated trades, you can now execute trades based on the UT Bot Alerts indicator.

- Log in to your TradingView account and go to the “Indicators” tab.

- Click on the “UT Bot Alerts” icon in the top right corner of the screen.

- Select an indicator from the drop-down menu.

- Select a trading strategy (e.g. Long/Short) and adjust its parameters as needed.

Conclusion

Automating your trades using the UT Bot Alerts indicator on TradingView.com with Binance is now easier than ever. By following these steps, you can set up an automated trading bot that executes trades based on pre-defined indicators, allowing you to trade BTC/USD (BTCUSDT) with confidence and accuracy.