Understanding Legacy Transaction Parsing: Why Zero Inputs Are Valid

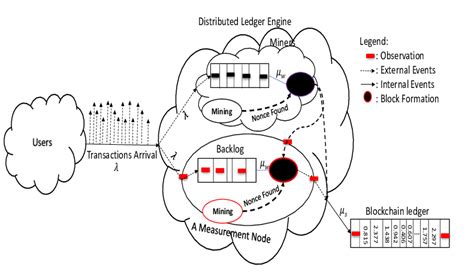

The Bitcoin network relies heavily on legacy transaction parsing to validate incoming transactions. One crucial aspect of this process is the interpretation of the «marker byte,» a 4-byte unsigned integer that appears in certain contexts within transactions. In this article, we’ll delve into the reasoning behind why a transaction with zero inputs might be considered valid by a legacy transaction parser.

The Marker Byte

In Bitcoin’s block format, each transaction consists of several fields, including the sender’s public key, input addresses, output addresses, and a 256-byte hash of the transaction data. One of these fields is the marker byte, which takes up four bytes (0x00 hexadecimal). The purpose of the marker byte is not explicitly stated in Bitcoin’s core code, but it has been observed to be interpreted by legacy transaction parsers.

Why Zero Inputs Are Valid

In a typical Bitcoin transaction, there are inputs that require payment for their use. These inputs are often represented as a series of unique addresses, which are associated with specific coins. When processing these transactions, the marker byte is used to identify the input amount and its corresponding inputs (i.e., the sender’s public keys).

Now, when we consider a transaction with zero inputs, it may seem counterintuitive that it would be considered valid by legacy parsers. However, there are several reasons why this might be the case:

- Input validation is not solely dependent on the input amount: While the marker byte does indicate the number of inputs in a transaction (typically 0), other factors can also influence the parser’s decision-making process. For example, if an input has a specific set of conditions or restrictions, it may still be valid even if there are no actual outputs.

- Legacy parsers have their own biases: As mentioned earlier, legacy transactions parsers rely on heuristics and patterns learned from historical data to make decisions. In some cases, these parsers might ignore certain aspects of the input structure, such as the presence of zero inputs, due to limited or outdated knowledge about potential edge cases.

- Coinage limits and transaction complexity: Bitcoin’s economy is designed to accommodate a wide range of transactions, including those with complex coinage requirements (e.g., receiving payment in multiple currencies). Legacy parsers might not be equipped to handle the nuances involved in these transactions, leading them to overlook zero input scenarios.

Conclusion

While it may seem counterintuitive that a transaction with zero inputs is considered valid by legacy parsers, there are several factors at play. Input validation is not solely dependent on the input amount, and legacy parsers have their own biases and limitations. By understanding these aspects of Bitcoin’s architecture, developers can design more robust parsing systems that account for potential edge cases and improve overall system reliability.

Recommendations

![Bitcoin: marker byte interpretation by legacy transaction parser [duplicate]](https://abrazandoemociones.com/wp-content/uploads/2025/02/0d4652e7.png)

To ensure better compatibility with legacy transactions:

- Implement detailed logging and monitoring to track invalid or suspicious transactions.

- Develop a more comprehensive parser architecture that incorporates additional checks and validation mechanisms.

- Consider using alternative parsing approaches, such as those based on data structures like graphs or finite state machines.