How to choose the right Stableco for your needs

In recent years, the world of cryptocurrency has grown explosively, and new signs and coins are created daily. Of these, the StableCoins has received significant attention due to their potential to provide safe assets for investors who are trying to diversify their portfolio. However, choosing the right Stablecoin can be overwhelming, especially when you meet numerous options. In this article, we will guide you to select your complete Stablecoin for your needs.

What is Stablecoin?

StableCoin is a digital currency that aims to maintain a stable value relative to its fiat currency, typically to the US dollar. This is achieved by attaching its value to another class of assets or assets, making sure that it does not vary too much against other currencies. The StableCoins has gained popularity due to their small volatility and liquidity.

Features of Good StableCoin

When choosing Stablecoin for your needs, consider the following features:

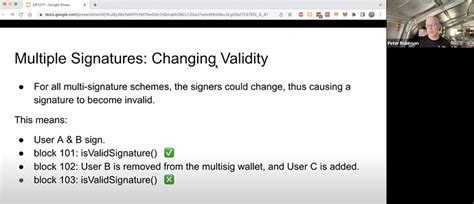

- Safety : Find stablecoins with strong safety measures, including multi-tier wallets, encryption and 2-factor authentication.

2

- Volatility : If you are satisfied with greater volatility, consider stablecoins such as Bitcoin (BTC) or Ethereum (ETH), who have historically experienced significant price fluctuations than others.

- Compliance with regulation

: Make sure that Stablecoin comply with regulatory requirements in your area, especially if you intend to use it for financial operations.

Considering

When evaluating Stablecoin, consider the following factors:

- Supply and Demand : Understand the market dynamics surrounding Stablecoin, including supply, demand and trading.

- Blockchain Technology : Explore the Blockchain Protocol used by StableCoin, making sure it is safe and scalable.

- Integration with other assets : If you intend to use Stablecoin together with another asset or asset class, it estimates its integration features.

- Payment processing fees : Understand the payment structure related to the use of stablecoin to process the payment.

Popular StableCoins

Some of the most popular Stablecoins are:

- TETER (USDT) : Wide -wide and highly liquid Stablecoin attached to US dollar.

- USD coin (USDC) : Stablecoin, supported by US dollar reserve, which makes it an attractive alternative to institutional investors.

- Binance USD (BNB) : Stablecoin, which is attached to the Binance ID that is traded on the Binance Exchange.

- DAI (DAI) : Stabilized by combination funding, utilizing decentralized loan protocols.

conclusion

Choosing the right Stablecoin for your needs requires a careful examination of different factors, including safety, liquidity, volatility and regulation. By evaluating these features and popular Stablecoine files, you can make a conscious decision on which Stablecoin is best suited to your goals. Remember to stay up to date with every market development and regulations around Stablecoin to ensure that you make the most appropriate choice for your financial needs.

Recommended

If you are a new StableCoine world, consider getting started with an established StableCoin such as USDT or USD coin (USDC). These StableCoins offers high liquidity, small volatility and solid security measures. With more experience and confidence in using stablecoins, you can explore more innovative options, such as DAI, who has gained a significant attraction among institutional investors.

Last tips

1.