Building token on Solana: Starting Guide

As the second largest smart contractual platform after Ethereum, Solana has become a popular choice for developers who want to create decentralized applications (Dapps) running on a quick and scalable blockchain. Creating the token with your own L2 (layer 2) platform is an exciting business and we are here to help you get started.

Understand the funds

Before you get into the ugly garbage of Solana-based token, it is essential to understand some basic concepts:

* Solana

: A fast and scalable blockchain network that allows you to execute a high-performance intelligent contract.

token **: The digital device issued on the blockchain is used as a replacement or value shop.

* L2 platform : Layer 2 scaling solution that fills complex transactions from the main chain, enabling it to be transferred faster and more efficiently.

Sources for learning

To build the token, you need to get to know the following resources with Solana:

- Solana Docs : Solana’s official documentation provides an exhaustive guide to set up a project, understanding intelligent contracts and exploiting the functions of the platform.

- Solana Community : Participate with the lively community of developers, validators and users through Solana Subreddit, Discord Server and other online forums.

- Tutorials and guides :

* Solana Tutorials on Github: A collection of tutorials and guides to start building smart contracts and interaction with Solana Blockchain.

* Koinos «Construction of token on Solana»: A comprehensive presentation that contains the foundations of the creation of the token, installation and management.

- Online courses :

* Solana bootcamp, Chainlink Labs: 10-week course that covers the basics of decentralized applications on Solana.

- Books :

* «Solana: The Intelligent Contract Platform», Peter Szalay: A detailed guide to understanding the Solana ecosystem.

rust for beginners

As a beginner, you need to know the rust to build a token with Solana. Rust is a system programming language that is widely used in the industry. To get started:

* Learn the basics of rust : Learn yourself with rust syntax, data structures and control flow.

* Select an IT : Install an integrated development environment (here), such as Visual Studio Code, Intellij Idea or Sublime Text to write and debugate the code.

less known gems

For those who are looking for additional sources in addition to official documentation:

- Solana’s Development Stock : A comprehensive package containing tools, libraries and guides to help build complex applications.

- Sola-SDK : Open Source SDK to develop Solana, providing a series of prepared features and classes to simplify the development workflow.

Tips to build a token

When you make tokens with Solana, don’t forget the following tips:

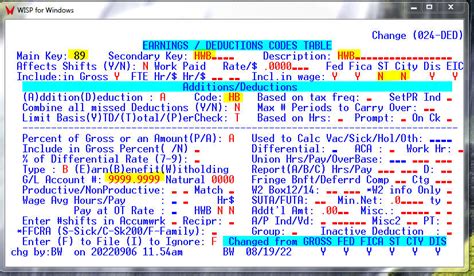

- Understand the Mechanism of Solana Consensus : Learn yourself with the Solana Consensus algorithm, gas limits and other system parameters.

- Select an appropriate token type : Decide the type of token you want to create (such as ERC-20, BEP-20 or Custom).

- Select the appropriate wallet integration : Select a wallet that supports the type of token you choose and has good documentation for interaction with Solana.

- Test and iterate : Test your application thoroughly before installing it in mainnet.

Conclusion

The structure of the token for Solana requires a solid understanding of the platform, rust programming language and the necessary resources. By following the guide and using these tips and recommendations, he is well on his way to the creation of a successful token, which keeps in mind his own L2 platform. Happy coding!