Mastering Bitcoin Wallets: A guide to understanding transactions, signatures, review, reception and collection

Bitcoin, the world’s first decentralized cryptocurrency, has revolutionized the way we think about digital transactions. With a growing number of users and a fixed series of wallets, understanding the use of topic is effective for everyone who wants to take part in the Bitcoin ecosystem. In this article, we will deal with the basics of Bitcoin letter management management, with a focus on transactions, signatures, review, reception and collection.

Understand Bitcoin transactions

Before we immerse ourselves with the briefing management, we start with the basics of Bitcoin transactions. If you send bitcoins from one address to another, a new transaction is created. These transactions are verified by the network that meet certain criteria before they are added to the blockchain. The most common types of transactions are:

* Confirmations

: Each individual transaction is confirmed by the network, adding the list of outstanding transactions.

* Unpasted transactions : Transactions without confirmations remain on the blockchain and are not part of the main chain.

Arrivals and addresses

A Bitcoin letter bag is a digital address that is used for saving, sending and receiving bitcoins. Each wallet has its own address, which serves as a public identification for the owner’s stocks.

Public addresses : These are the most common addresses in Bitcoin transactions. They are usually in the format of «1G4xy9j8xg …»

* Private key : A private key is used to unlock and manage the associated wallet. It is a long, unique string used to sign transactions.

Signing transactions

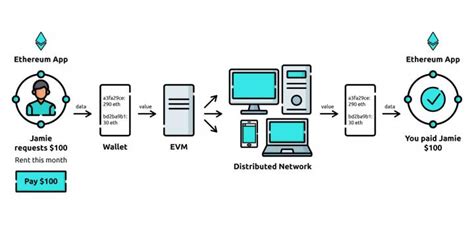

Signatures are of essential importance for checking the transactions on the blockchain. If you send bitcoins, your signature proves that you have these coins and authorize the transaction. The process of producing signatures includes:

- Private key generation : The private key of each user is generated using its corresponding public address.

- Transactional creation : A new Bitcoin transaction is created with a certain sender (you) and recipient addresses.

- Signature creation : Your private key is used to create a signature for the transaction, which is essentially your «fingerprint», which proves ownership.

Checking the transactions

To check transactions on the blockchain, you must check whether you have been confirmed by other users in the network. The process of reviewing transactions includes:

- Transaction list : You can display the entire list of outstanding and confirmed transactions using tools such as blockchair or Bitcoin Core.

- Transaction history : Each transaction has a time stamp with which you can track the order of events.

receipt and collection

As soon as a transaction has been confirmed, it is added to the blockchain and becomes part of the main tracks. That means:

You are not the owner : If a transaction is not signed with your private key, it is rejected by other users in the network.

* Transactions are irreversible : As soon as a transaction has been confirmed, it cannot be reversed or canceled.

Tips for new users

To start with Bitcoin Wallet Management, follow the thesis tips:

* Use a secure wallet : Select a reputable and well -shaped item pocket provider that sacrifices robust safety functions.

Keep your private key : Never share your private key publicly or write it down in an insecure place.

Use the two-factor authentication (2FA) : Activate 2FA on your wallet to add an additional security level against hacking tests.

Diploma

Mastering Bitcoin Wallet management requires understanding the basics of transactions, signatures, review, preservation and collection.