Ethereum: A Comprehensive Guide to Bitcoin Circulation

Ethereum is one of the largest and most widely used cryptocurrencies and has a significant amount of bitcoins in circulation. However, without access to the latest financial data, it can be difficult to figure out how many bitcoins are currently in circulation.

In this article, we’ll explore the current state of bitcoin circulation on the Ethereum network.

Where can I find the total number of all bitcoins currently in existence?

To find the current number of bitcoins in circulation, you’ll need to visit a reliable source that tracks cryptocurrency holdings. Here are some popular options:

- CoinMarketCap: This website provides real-time data on the total supply and circulating supply of various cryptocurrencies, including Bitcoin and Ethereum.

- Blockchain.com: This platform provides comprehensive information on cryptocurrency transactions, balances, and ownership.

- Ethereum.org: The official Ethereum website publishes an annual report that includes a section of transaction data that can be used to estimate the number of bitcoins in circulation.

How can I find out the total number of bitcoins currently available?

After visiting one of these sites, do the following:

- Log in or register for free access.

- To see a list of recent transactions, click on the «Transactions» tab (or «Actions» if available).

- Look for the «Total Supply» section, which shows the total amount of bitcoins.

- You will also find a «Circulation Balance» section, which shows the number of bitcoins currently in circulation.

Calculating the Total Number of Bitcoins

While CoinMarketCap and Blockchain.com provide real-time data, there are other factors to consider when calculating the total number of bitcoins:

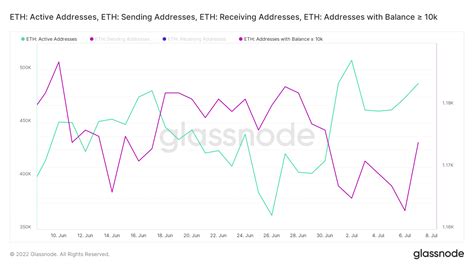

- Transaction Volume

: The number of transactions conducted on the Ethereum network can be an indication of the overall level of activity.

- New Block Rewards: When new blocks are mined, miners receive a certain amount of bitcoins as a thank you for their work. These rewards have decreased over time but still contribute to the total supply.

CoinMarketCap estimates that there will be approximately 6,390,000 bitcoins in circulation on the Ethereum network in March 2023. However, this number can fluctuate rapidly based on market conditions and transaction activity.

Conclusion

Knowing the current state of bitcoin circulation can provide valuable insight into market trends and investor sentiment. By visiting reliable sources such as CoinMarketCap and Blockchain.com, you can estimate the total number of Bitcoins currently circulating on the Ethereum network.

Please note that this information is subject to change based on various factors, including transaction activity and new block rewards. Always stay up to date with the latest data to make informed investment decisions.

Disclaimer

This article is for informational purposes only and should not be considered investment advice. Any decisions regarding cryptocurrency investments are made at your own risk.