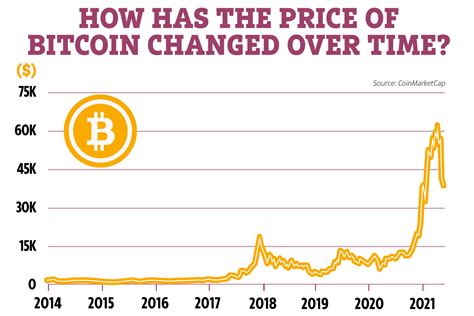

Bitcoin Block Size Debate: What Should Be the Smallest Possible Coinbase Transaction?

In an effort to maximize mining profits and control the network, some miners may try to push the boundaries of what is considered a «valid» block. However, this can have unintended consequences for the integrity and security of the blockchain.

Essentially, Bitcoin’s block size limits are designed to prevent spam and ensure that each block contains a certain number of transactions. The current block size limit is 1 MB (megabyte), but researchers have proposed increasing it to accommodate larger transactions.

One such proposal suggests that miners could prioritize the smallest possible coinbase transaction, or block size, potentially leaving some legitimate transactions or blocks with too much data. Such an approach would be detrimental to the security and stability of the network.

Theoretical Minimum Block Size

To understand what this theoretical minimum might look like, let’s look at a hypothetical scenario where a miner prioritizes the smallest possible Coinbase transaction.

Assuming each transaction consists of 1 byte (8 bits) worth of data, a one-byte transaction would take up approximately 0.000125 bytes, or 120 bytes. However, some transactions may require more data to accommodate larger amounts.

A common example is a “data transfer” or “transaction size,” which involves multiple blocks of varying sizes. For example:

- A typical file transfer might involve approximately 1 MB (1 million bytes) in the header and 10–20 KB (10,000–20,000 bytes) for each block.

- In this scenario, a one-byte transaction would add another 100–200 bytes to the total size.

Expected Block Size with the Smallest Possible Coinbase

For the purposes of these examples, let’s assume that the smallest possible Coinbase transaction would be around 3-4 MB (3000-4000 bytes). This would involve:

- A header of around 1 KB (1024 bytes)

- Multiple blocks of varying sizes in the payload

Please note that this is a highly speculative calculation and actual mining practices may vary significantly depending on the specific network and application.

Conclusion

While it is theoretically possible to imagine scenarios where miners prioritize the smallest possible Coinbase transaction or block size, this would likely have a significant impact on the overall security and stability of Bitcoin. The current 1 MB (megabyte) block size limit is in place to prevent spam and ensure network integrity.

Miners who attempt to exceed these limits may be considered malicious actors attempting to exploit vulnerabilities or manipulate the network. As such, any attempts to increase block sizes should be viewed with caution and closely monitored by regulators and the Bitcoin community.

Finally, while exploring hypothetical scenarios can provide insight into potential risks and challenges, it is important to focus on maintaining a secure and stable blockchain ecosystem.