Exploration of the potential of Hedera (Hbar) and its impact on decentralized finance (DEFI)

In the field of cryptocurrencies, few projects have drawn the attention of investors and enthusiasts as much as Hedera Hashgraph (Hbar). As a leading digital intake, Hbar has been gaining momentum lately, with its potential to disrupt traditional financial systems and revolutionize the DEFI landscape. In this article, we will immerse ourselves in the world of Hbar, exploring its technology, its advantages and its impact on the DEFI space.

What is Hedera (Hbar)?

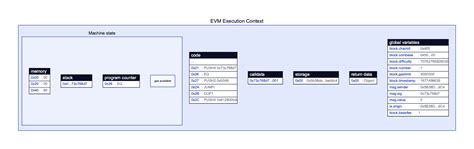

Hedera Hashgraph (Hbar) is a decentralized public blockchain project that uses an algorithm of owner consensus called hashgraph. Developed by Watanabe Group, a Japanese technology company, Hbar aims to create a secure, scalable and low latency platform for various use cases beyond traditional cryptocurrencies.

Key characteristics of Hedera

- Secure consensus algorithm : Hashgraph consensual algorithm is designed to be very resistant to centralization and manipulation, guaranteeing the integrity of the network.

- Evolution : Hbar aims to reach faster transaction treatment time 50 times compared to Bitcoin, making it an attractive option for trading and high frequency challenge applications.

- LAFENE BASE : With a block time of only 4 seconds, Hbar allows a rapid transaction regulations and a reduced shift.

- SECURITY : HEDERA’s safety features include advanced encryption, multi-signating portfolios and regular hard forks to prevent centralization.

advantages of Hedera (Hbar)

- ** Spedition of Translation Higher: Faster transactions processing times make Hbar an ideal platform for high-frequency trading applications in the DEFI space.

- Reduction of slip : Low LENCY allows investors to react quickly to marketing fluctuations, reduction in shift and growing confidence in their investments.

- Increased safety : Hedera’s robust security features offer peace of mind to users, making it an attractive option for institutional investors and individuals.

Impact on decentralized finance (DEFI)

The potential impact of Hbar on Defi is significant, as it is:

- Reduces centralization

: By taking advantage of a secure and evolving consensual algorithm, Hbar reduces the risk of centralization and manipulation in DEFI applications.

- FOSTERS TRUST : The use of Hashgraph safety features and the regular FOSTERS FOSTERS TRUST between DEFI users, making it an attractive option for institutional investors.

- Activates high frequency trading : with faster transaction treatment times and a reduced shift, Hbar allows high frequency negotiation applications in the DEFI space.

Applications DEFI With Hedera (Hbar)

The potential impact of Hedera on Defi is not limited to its own platform. The use of safety features and Hashgraph scalability capacities makes it an attractive option for various DEFI applications, in particular:

- Decentralized Exchange (DEX) : The treatment times for rapid Hbar transactions and the low latency make it adapted to high -frequency dexx.

- Oracles : The secure consensus algorithm of Hedera ensures the integrity of oracles, allowing reliable data flows in the DEFI applications.

- Gaming : The use of safety features and Hashgraph scalability capacities makes Hbar an attractive option for game platforms that require rapid transaction processing times.

Conclusion

Hedera (Hbar) has become a leader in cryptocurrency space, with its potential to revolutionize traditional financial systems and challenge applications. With its secure consensus algorithm, its evolutionary platform, its low latency and its security features, Hbar is well positioned to disturb the status quo and create new opportunities for investors and users.