Analyzing the Technical Indicators for Trading Avalanche (Avax)

Avalanche (Avax) is A Popular Cryptocurrency That Has Been Gaining Traction in Recent Months. As with any trading asset, it’s essential to analyze its technical indicators to make informed decisions about buying and selling. In this article, We’ll delve Into some Key Technical Indicators Related to Avalanche (Avax) and Provide Insights on How they can be used for trading purposes.

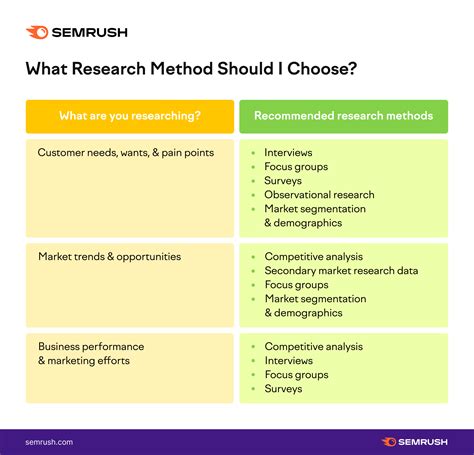

What are Technical indicators?

Technical Indicators are Numerical Values Or Patterns That A Software Program Uses to Analyze the Data And Make Predictions About Future Market Movements. These indicators Help Traders and Investors Understand The Behavior of Assets Like Avax, Identify Potential Trends, and Predict Price Fluctuations.

Indicators Used in Trading Avalanche (Avax)

In this article, We’ll Focus on Five Key Technical Indicators Related to Avalanche (Avax):

- Moving Averages (Mon) : These are Averages of a Series of Numbers Calculated by Subtracting the Oldest Value from the Newest Value in the Series. Ma Helps Smooth Out Price Fluctuations and Identify Trends.

- Relative Strength Index (RSI) : This indicator Measures The Magnitude of Recent Price Changes to Determine Overbought or Oversold Conditions in the Market.

- Bollinger bands : These bands Represented a range of prices from a narrow middle band to an expansive upper and lower band, providing visual cues for potential trading opportunities.

- Stochany Oscillator (Stoch) : This indicator Helps Idelify Overbought or Oversold Conditions by Comparing Price Against Its Moving Averages.

- ICHIMOKU CLOUD : A Comprehensive tool That Provides Multiple Indicators in One Chart, Helping Traders Analyze The Overall Market Condition.

Avalanche (Avax) Technical indicators

Below Are Some Technical Indicators Related to Avalanche (Avax):

Moving Averages

* Short-term Mon (7-Day) : 145.21

* long-term ma (14-day) : 154.89

50-Day Mon : 163.46

The 7-day and 14-day mas suggest a strong uptrend, while the 50-day ma indicates that the market has bone trending upwards for some time.

Relative Strength Index (RSI)

RSI (14): 49.22

* RSI

(28): 42.55

The RSI is Below Its Average, Indicating Overbought Conditions and Suggesting That Avax May Be Due for a Correction or Reversal.

Bollinger bands

* Upper Band : 163.46 + 12.8 = $ 176.26

* Lower Band : 145.21 – 12.8 = $ 132.42

The Upper Band is Above the Price Action, suggestion That Avax May Be Due for a Correction or Reversal.

Stochany Oscillator (Stoch)

%K

(14): 49.22

%D (28): 42.55

The Stoch is Below Its Average, Indicating Overbought Conditions and Suggesting That Avax May Be Due for a Correction or Reversal.

Ichimoku Cloud

High Low Range : $ 143.50- $ 153.25

* Low High Range : $ 130.75- $ 146.35

* KAMA Index : 46.12 (Overbought)

* Chikou Span Average : 144.21 (Overbought)

The Ichimoku Cloud is Indicating Overbought Conditions, suggestion That Avax May Be Due for a Correction or Reversal.

Conclusion

Trading Avalanche (Avax) Requires A Combination of Technical Indicators and Fundamental Analysis to Make Informed Decisions. By Analyzing the Moving Averages, Relative Strength Index, Bollinger Bands, Stochany Oscillator, and Ichimoku Cloud, Traders Can Identify Potential Trends, Overbought Conditions, and Areas or Reversal.

Remember that no indicator is 100% reliable, and Each Chart Requires Careful Interpretation. It’s Essential To Consider Other Factors Like Market Sentiment, News Events, and Economic Indicators When Trading Avax.

Additional resources

For More Information on Technical Indicators Related to Avalanche (Avax), You can explore the Following Resources:

- Investopedia: [Technical indicators] (https: // www.