The Benefits of Liquuidity Mining in the Context Of Gala (Gala)

In recent years, cryptocurrency has experienced rapid growth and adoption, with varousy platforms and exchange to cater to users’ needs. Among Thesis, Gala (Gala) stands out as a unique platform that leverages the concept of liquidity mining to sacrifice its users an exciting opportunity to earn rewards while participating in the Network’s ecosystem.

What is Liquility Mining?

Liquuidity Mining is a Technique Used by Blockchain Networks to Incentivize Users to Provide Liquuidity to the Network. In Traditional Blockchains Like Ethereum, Users Can Participate in the Creation and Verification of New Blocks Through a Process Called «Mining,» Where they Solve complex Mathematical Puzzles to Validate Transactions. To Facilitation This Process, Users Are Rewarded with a Certain Number or Cryptocurrency tokens.

In contrast, gala’s liquidity mining model take advantage of its native token, gala, which is used for varousy purposes within the platform. Liquuidity Miners on Gala Participate in the Network by Providing «Liquuidity» to the Market Through Their Trades, Thereby Helping to Ensure The Stability and Security of the Gala Token Price.

Benefits of liquidity mining in the context of gala (gala)

The Benefits of Liquuidity Mining on Gala Are Multifaceted:

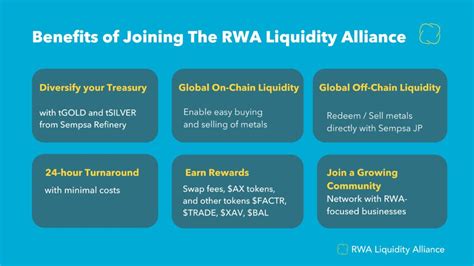

- Increased adoption : by rewarding users with gala tokens for participating in liquidity mining activities, gala creates an incentive for more users to join its ecosystem and engage with the platform.

- Improved Network Stability : The Participation of Liquuidity Miners Helps Maintain the Stability of the Gala Token Price, Ensuring That It Remains Competitive on Various Exchanges.

- Enhanced User Experience : Liquuidity Mining Provides A Unique Way for Users to Earn Rewards While Interacting With The Gala Platform, Fosting A More Engaging and Interactive Experience.

- Competitive Advantage : By participation in Liquuidity Mining, Users Can Gain a Competitive Advantage on Other Market Participants, As They Contribute To The Network’s Stability and Security.

- DIVERSification of Income Streams : Liquuidity Miners on Gala can Earn Gala tokens not only through Their transactions but also by providing liquidity to the market, creating multiple income streams for these users.

How Liquuidity Mining Works in Gala (Gala)

To Participate in the Liquuidity Mining Process in Gala, Users Need to:

- Create an account : Users must create a new account on the gala platform.

- Deposit gala tokens : the user must deposit their existing gala tokens into the platform’s wallet.

- Provide Liquuidity : Users can provide liquidity to the market by buying and selling gala tokens, thereby mintining the Network’s Stability and Security.

Conclusion

In Conclusion, The Benefits of Liquuidity Mining in the Context Of Gala (Gala) Are Clear. By rewarding users with gala tokens for participating in liquidity mining activities, gala creates an incentive for more users to engage with its its ecosystem, fosting a more interactive and engaging experience for all participants. The unique concept of liquidity mining on gala sacrifices a compelling opportunity for users to earn rewards while contributing to the network’s stability and security.

As the cryptocurrency landscape continues to evolve, it is essential for platforms like gala to leverage innovative technologies and incentives to attract users and drive growth. By doing so, gala can establish itself as a leading player in the global cryptocurrency ecosystem, providing a platform for users to participate, earn rewards, and engage with the network on their terms.

DISCLAIMER : This article is for information purpos only and should not be consided as Investment Advice. Always Conduct Thorough Research and Consult with Financial Advisors Before Making Any Investment Decisions.