USD Coin (USDC): A Stable Asset for Traders

In the rapidly evolving world of cryptocurrency, traders are constantly seeking ways to diversify their portfolios and mitigate risks. One asset that has gained significant traction in recent years is USDC (USD Coin), a stablecoin pegged to the value of the United States dollar. In this article, we will explore what makes USD Coin an attractive option for traders, its benefits, and how it can be used as a stable asset.

What is a Stablecoin?

A stablecoin is a cryptocurrency that is designed to maintain a fixed ratio with another currency, such as the US dollar. This ensures that the value of the stablecoin remains relatively stable relative to the underlying currency. Stablecoins are often created by central banks or financial institutions to provide an alternative to traditional fiat currencies.

What is USD Coin (USDC)?

USD Coin (USDC) is a stablecoin created by Coinbase, a popular cryptocurrency exchange. It was launched in 2018 and has since gained significant traction among traders. USDC is pegged to the value of the US dollar at a fixed rate of 1:1, ensuring that its value remains stable relative to the dollar.

Benefits for Traders

USD Coin offers several benefits for traders:

- Risk Management: By using USD Coin, traders can mitigate risks associated with traditional cryptocurrencies like Bitcoin or Ethereum, which have experienced significant price swings in recent years.

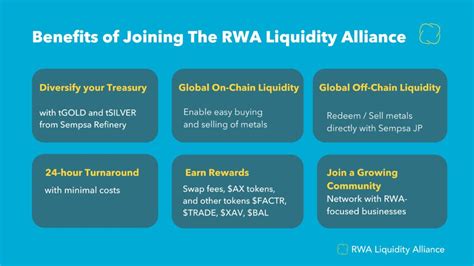

- Diversification: USDC allows traders to diversify their portfolios by adding a stable asset that is not tied to the performance of other cryptocurrencies.

- Liquidity: USD Coin has a high liquidity rate, making it easy for traders to buy and sell assets quickly and efficiently.

- Scalability

: USDC can be easily scaled up or down depending on trading volumes, allowing traders to manage their portfolio size more effectively.

How is USD Coin (USDC) Used?

USD Coin is used in a variety of ways:

- Trading: Traders use USDC for day trading and swing trading, as it provides a stable foundation for their portfolios.

- Investing

: Investors can use USDC to buy and sell assets, such as stocks or bonds, with relative ease.

- Paying Fees: Traders can use USDC to pay fees on cryptocurrency exchanges, such as Coinbase, without incurring high transaction fees.

Benefits of Using USD Coin (USDC) for Trading

- No Risk of Price Volatility: By using USD Coin, traders are protected from the risks associated with price volatility in other cryptocurrencies.

- Flexibility: Traders can use USDC to trade various assets and manage their portfolios more effectively.

- Liquidity: The high liquidity rate of USD Coin makes it easy for traders to buy and sell assets quickly.

Conclusion

USD Coin (USDC) is a stable asset that offers several benefits for traders, including risk management, diversification, scalability, and liquidity. With its fixed ratio pegging to the US dollar, USDC provides a stable foundation for portfolios without exposing them to price volatility associated with other cryptocurrencies. As a stable asset, USD Coin is an attractive option for traders seeking to mitigate risks while still benefiting from the potential growth of cryptocurrencies.

Risks

While USD Coin offers several benefits, it’s essential to remember that investing in any cryptocurrency carries inherent risks. Traders should always do their own research and consider their individual risk tolerance before using USDC or any other asset. Additionally, traders should be aware of regulatory changes that may impact the stability of stablecoins like USDC.

Recommendation

USD Coin (USDC) is an attractive option for traders seeking a stable asset that offers benefits such as risk management, diversification, and liquidity.