Optimizing Transaction Fees: Strategies for E-Wallets

When it comes to managing transaction fees on the Ethereum network, e-wallets play a crucial role in minimizing costs and ensuring seamless transactions. Despite Bitcoin’s lack of fee-based withdrawal system, many popular exchanges have adopted various strategies to reduce their own transaction fees. In this article, we’ll delve into some effective strategies that e-wallets can implement to optimize their fees.

Underlying Concepts

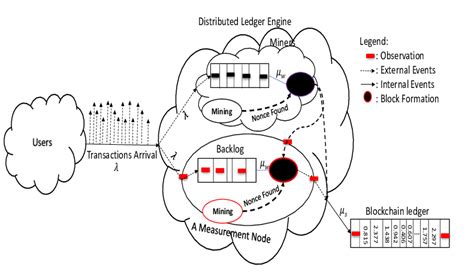

Before diving into specific strategies, it’s essential to understand the underlying concepts driving Ethereum’s high fees. The primary factor contributing to high fees is the complexity of transactions and the number of gas units (ETH) involved in them. As a result, transaction processing times are longer, leading to increased costs.

Strategies for E-Wallets

- Optimize Transaction Order Book (TOB) Management: By strategically managing the order book on your e-wallet platform, you can reduce the number of gas units required for each transaction, resulting in lower fees. This is achieved by:

- Balancing orders to ensure a balanced liquidity pool

- Minimizing the number of simultaneous transactions

- Optimizing gas prices and fees

To implement this strategy, e-wallets need to analyze their order book and adjust it accordingly to reduce the average gas unit cost.

- Gas Price Optimization: Gas price optimization involves identifying the most energy-efficient gas price for each transaction type (e.g., ETH/ETH, ETH/USD). By choosing the optimal gas price, you can:

- Reduce gas costs

- Increase the number of transactions per second

- Enhance overall network efficiency

E-wallets should analyze their usage patterns and adjust their gas pricing strategy to match demand.

- Gas Limit Management: Gas limit management is critical for minimizing transaction fees. By adjusting the gas limits set on your e-wallet platform, you can:

- Reduce gas costs by limiting transactions

- Increase the number of transactions per second

- Improve network efficiency

To implement this strategy, e-wallets should monitor their gas usage and adjust the gas limit settings to match demand.

- Gas Estimation Tools: Using accurate gas estimation tools allows e-wallets to predict transaction costs before they occur. This enables them to:

- Optimize transactions by adjusting gas limits or choosing optimal gas prices

- Minimize gas costs for users

Some popular gas estimation tools include the Ethereum Gas Estimator and the OpenZeppelin Gas Estimator.

- Integration with Smart Contract Platforms: Integrating e-wallets with smart contract platforms can help reduce transaction fees by leveraging the network’s computational power. This is achieved by:

- Using smart contracts to process transactions in parallel

- Optimizing gas usage for specific use cases

By integrating e-wallets with smart contract platforms, you can create more efficient and cost-effective payment systems.

Implementation Strategies

To implement these strategies effectively, e-wallets should consider the following implementation strategies:

- Integrate Gas Estimation Tools: Integrate gas estimation tools into your e-wallet platform to predict transaction costs.

- Optimize Transaction Order Book Management: Balance orders and optimize gas prices to reduce average gas unit costs.

- Implement Gas Limit Management: Adjust gas limit settings based on usage patterns to minimize gas costs.

- Use Smart Contract Platforms

: Integrate with smart contract platforms to leverage network computational power for optimized transactions.

Conclusion

Reducing transaction fees is a crucial aspect of optimizing the Ethereum ecosystem. By implementing these strategies, e-wallets can minimize costs and ensure seamless transactions.