«The Unyielding Hold of Uncertainty: Cryptocurrency Settlement Risk on the Horizon»

As the cryptocurrency space continues to grow in popularity, one major concern that investors and traders must grapple with is settlement risk. This uncertainty can have far-reaching consequences for users, exchanges, and even the broader market itself.

Settlement risk refers to the potential for payment systems to fail or malfunction, leaving individuals without access to their funds. In the cryptocurrency space, this risk is exacerbated by factors such as high liquidity, complex trade structures, and decentralized networks that lack traditional regulatory oversight.

One of the primary concerns with settlement risk in crypto is the exchange listing process itself. When a new exchange lists a cryptocurrency, it creates a critical link between buyers and sellers, which can be broken if the exchange fails to maintain its infrastructure or liquidity. In many cases, this failure has led to significant losses for traders, particularly those who have invested heavily in the cryptocurrency.

The stakes are further complicated by the fact that some exchanges have been known to experience technical glitches, data breaches, or other issues that can disrupt trading and settlement processes. For example, the infamous Mt.Gox hack in 2014 highlighted the importance of robust security measures in crypto exchanges. While Mt.Gox eventually resolved its issues, the incident serves as a cautionary tale for exchanges looking to avoid similar problems.

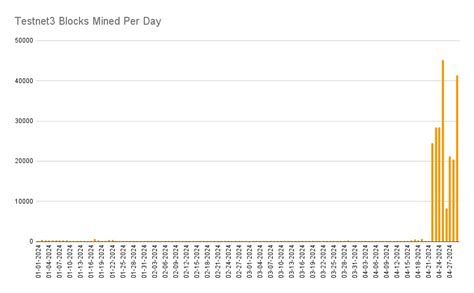

Another critical factor contributing to settlement risk is the mempool – a critical component of decentralized finance (DeFi) protocols that enables users to execute trades and transfer assets without the need for intermediaries like banks. The mempool is essentially a high-capacity, low-latency queue of transactions waiting to be executed by the protocol’s nodes.

However, as the mempool grows in size, it can become increasingly difficult to process transactions efficiently, leading to delays, congestion, and even network partitions. This can have catastrophic consequences for users, particularly those who rely on real-time execution of trades or transfer of assets.

To mitigate settlement risk, exchanges and protocol developers are exploring innovative solutions such as decentralized governance models, tokenized settlements, and distributed ledger technologies like blockchain 2.0. These initiatives aim to create more resilient, efficient, and secure payment systems that can better withstand the uncertainties associated with crypto transactions.

In conclusion, while the risks of settlement in crypto may seem abstract or esoteric, they represent a tangible threat to users, exchanges, and the broader market itself. As the cryptocurrency space continues to evolve and mature, it is essential for investors, traders, and protocol developers to prioritize settlement risk management and explore innovative solutions to mitigate these challenges.