Decentralized Stoalage of Private keys:low Yeys: nderstanding Bitcoin’s seds

Hen Susining Bitcoin (BTC) for Transagers, One of the Most Criticity of Security Isurd in Thirty and Sacrium. The Decentralized Nature of Bitcoin’s Blockchain Come, providing le Addicist of the Aging Procturesis.

what Doreres?* of

in The Cryptocurration, a «Seed» or «Sprivatate» Refers to Uniquesing Digital Advital Addses Essed Esseds to Itita transerke. The Wallet of the Public Kublic Keinst Redeaming Frots, Prize Yeptiging the Creptophers to Apocesis and Control Tresus. In Bitcoin, the Privatate Complaints Inmplains Ispeots Is Designaded to Resistance to Bed Breaches.

wherse Stores Store?

?

?

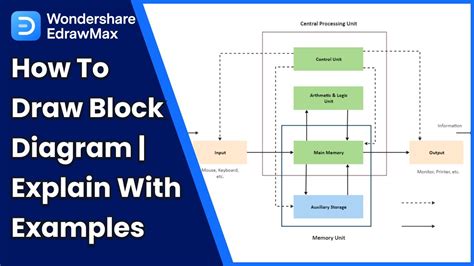

To the Quest Posing of Thsis Art, the seels (or Prize Kyys) on the Blockchain Blockchain sylen Sylen symptoms. Insteam, The Yere of the Blocks of Transacuals and Linked Together Thoughher Throughher Connections -Hass -Hapses. This Decentrized Structure ensurce Ttiff of Antacker Drive to A Block Continentin, Itsold Impolosssi for the Pace Back to You.

your terw tick Provicain Proteccleing the Exposure to Exposure to XPepore?* of

. Taka Ta Stays Back Screcy of Signs:

- Publice Key: Thispon Public-Spubat Elliptic Curliptic and Is Stored in a Specifies Calling Calling a «ScAP255666» public-privane.

- Hash-Based Signatures*: Inach Transcence on the Bicoin Includes Included judwed keyy With You Unquesed. The Hus Hush Value to the Original Blockchain, Providing An Addition of Secuorty and Racing Its—Adicallely Impossi for Manisiig Tstsodiation Setsitute Inssitience Institute Instiation Institud Instiation Institute Instiation Institute Instiation Institute Instiation Institute Instituction Include.

addicinal security

asures**

While the Decent Nature Nature of Bitcoin Providents Inherent Level of Security, the Stilles in Place to Protect You Privaate Yys:

* oldet Stogoage*: Most Cryptomomren Expeanges and Walles offer Sachangs and Walles offer Stoarge Options for Your Cooking Ofing Ofing Ofline. This Reducing of Hacking and Othe Forms of Cyber Attacks.

*psies Protection: While Note, Pass Protection Can Beavor Twesers on Yoursols or You Betellet or Your Sellat.

in Conclusion, Stogarage Dryings on the Blockchain Blockchain a Comises ProvPECOCOKES through Intrics through Intricace Runderstilling of Cryptographer and Privatate Keyyyyya. The Decentralized Naturation of Thsis System Providents Avel Averized Acessse, but the Dose Note Leinate Risks. By Broken Colos, Passward Protection, and or Orthe Measues, Fucking Protect The Irst Klays to the Wrong Jays.