Here is a comprehensive article on «Crypto», «Uniswap», «Digital Asset Management» and «Token Minting».

Crypto Market Update: A Guide to Uniswap, Digital Asset Management and Token Minting

As the world of cryptocurrency continues to grow in popularity, many individuals are looking for new ways to invest, manage their assets and participate in decentralized finance (DeFi). Two popular platforms that have gained significant traction among cryptocurrency enthusiasts are Uniswap and Digital Asset Management, as well as token minting services. In this article, we will delve into the world of these three topics and explore what they mean for both investors and users.

Uniswap: A DeFi Market Maker

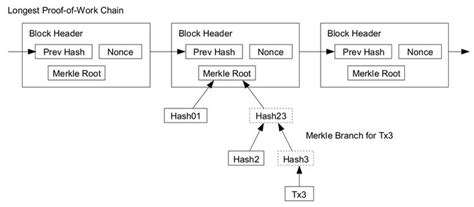

Uniswap is a decentralized exchange (DEX) on the Ethereum blockchain that allows users to trade cryptocurrencies with each other without the need for intermediaries. What sets Uniswap apart from traditional exchanges is its market maker model, which allows it to provide liquidity and facilitate trades between users.

Uniswap’s unique architecture enables more efficient and cost-effective trading, reduces transaction costs, and increases the overall efficiency of the DeFi ecosystem. The platform uses a liquidity pool model where users can deposit and withdraw assets at any time, eliminating the need for centralized exchanges to maintain liquidity.

One of Uniswap’s key features is its smart contract-based architecture, which enables seamless interactions between users, smart contracts, and other decentralized applications (dApps). This enables more complex trading strategies and increased market efficiency.

Digital Asset Management: A New Era for Crypto Storage

Digital Asset Management (DAM) has emerged as a key component of the crypto ecosystem, providing secure and transparent solutions for storing digital assets. DAMs allow users to store, manage, and transfer cryptocurrencies in one place, eliminating concerns about security risks and regulatory compliance.

Uniswap’s Digital Asset Management platform is built on Ethereum and allows users to store their cryptocurrencies in a decentralized manner. The platform uses a blockchain-based storage solution that enables secure and transparent management of digital assets.

Token Minting: A Growing Market for Cryptocurrency Creators

Token minting is an increasingly popular feature in the crypto space, allowing creators to issue new tokens with unique features or use cases. Token minting platforms have gained significant traction among developers and businesses looking to create and distribute their own cryptocurrencies.

Uniswap’s token minting capabilities allow users to create, list, and trade their own tokens on the platform. The platform employs a robust governance model that allows users to vote on token features and development proposals.

Benefits of Token Minting

Token minting offers several benefits for cryptocurrency creators and businesses:

- Decentralized Control

: Token minting allows creators to maintain full control over their assets without relying on centralized exchanges or intermediaries.

- Increased Liquidity: Token minting can increase the liquidity of tokens in the market, making them easier to buy and sell.

- New Use Cases: Token minting allows for the creation of new use cases and features that were previously impossible to implement.

Challenges and Limitations

While token minting offers many benefits, there are also several challenges and limitations to consider:

- Regulatory Compliance: Token minting must meet regulatory requirements, which can be complex and time-consuming.

- Security Risks: Token minting platforms must take steps to mitigate security risks, such as ensuring the integrity of smart contracts and preventing token theft.