Ethereum: Binance API Transaction History

Binance is one of the largest and most popular cryptocurrency exchanges, offering a wide range of APIs for developers to interact with their platform. In this article, we will explore how to retrieve Ethereum transaction history using the Binance API.

Prerequisites

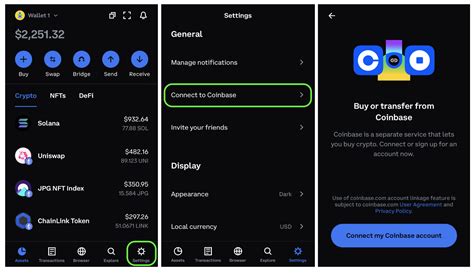

Before you begin, make sure you have an account on Binance and have created a developer account on the Binance Developer Portal. You will also need to obtain an API key from the Binance API dashboard.

API Endpoints for Retrieving Transaction History

To retrieve Ethereum transaction history using the Binance API, you can use the following endpoints:

GET /api/v3/transactionHistory(get transactions by block number and timestamp)

GET /api/v2/orders(get order history) – this endpoint will give you access to your own trading activity

GET /api/v2/tradeHistory(get trade history) – this endpoint will give you access to your own trading activity

Retrieve transaction history using the /api/v3/transactionHistory endpoint

The GET /api/v3/transactionHistory endpoint allows you to retrieve Ethereum transaction history by block number and timestamp. Here is an example of how you can use this endpoint:

curl -X GET \

\

-H "Content-Type: application/json" \

-H "Authorization: bearer YOUR_API_KEY"

Replace YOUR_API_KEY with your actual API key. This will return a JSON response containing the transaction history for the specified symbol, block number, timestamp, and side.

Fetch transaction history using the /api/v2/orders endpoint

The GET /api/v2/orders endpoint allows you to retrieve order history from Binance. To use this endpoint with your Ethereum API key, follow these steps:

curl -X GET \

\

-H "Content-Type: application/json" \

-H "Authorization: bearer YOUR_API_KEY"

Replace YOUR_API_KEY with your actual API key.

Fetch trade history using the /api/v2/tradeHistory endpoint

The GET /api/v2/tradeHistory endpoint allows you to retrieve your trade history from Binance. To use this endpoint, follow these steps:

curl -X GET \

\

-H "Content-Type: application/json" \

-H "Authorization: bearer YOUR_API_KEY"

Replace YOUR_API_KEY with your actual API key.

Example Use Cases

Here are some example use cases for these APIs:

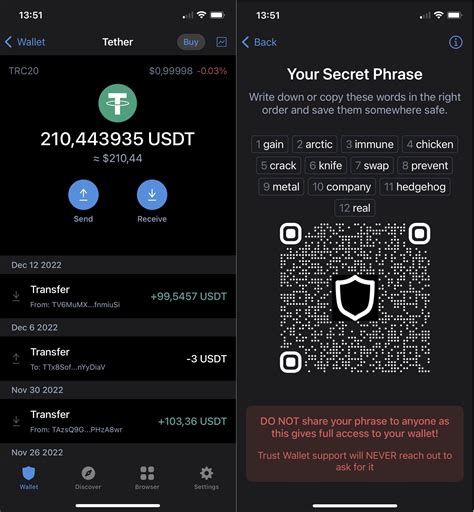

- Retrieve a user’s Ethereum deposit history

: You can query the

/api/v3/transactionHistoryendpoint to retrieve all transactions made by a specific user. To do this, you will need to add anaccount_idparameter to the endpoint.

curl -X GET \

\

-H "Content-Type: application/json" \

-H "Authorization: bearer YOUR_API_KEY"

- Get Ethereum withdrawal history for a user: You can query the

/api/v2/ordersendpoint to retrieve all orders made by a specific user. To do this, you will need to add anaccount_idparameter to the endpoint.

curl -X GET \

\

-H "Content-Type: application/json" \

-H "Authorization: bearer YOUR_API_KEY"

- Retrieve a user’s Ethereum transaction history: You can query the

/api/v2/tradeHistoryendpoint to retrieve all transactions made by a specific user. To do this, you will need to add anaccount_idparameter to the endpoint.

I hope this helps! Let me know if you have any questions or need further assistance.