Cryptocurrency: Fundamental evaluation: Determining the true value of tokens

The cryptocurrency world has been on a wild ride since its creation in 2009. From Bitcoin to Ethereum and Altcoins to Stablecoins, the landscape is constantly evolving as new players emerge and those existing adapt to changes in market conditions. However, amid all the emotion and speculation around these digital assets, fundamental assessment remains a crucial aspect of investment in cryptocurrencies.

What is fundamental assessment?

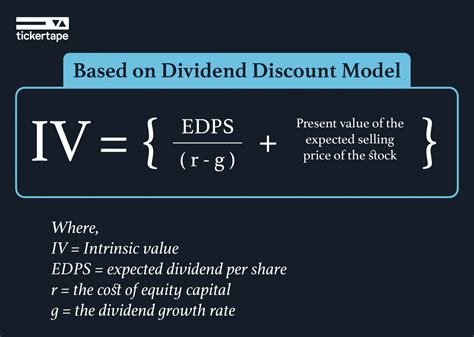

Fundamental evaluation refers to the process of estimating the value of a cryptocurrency based on their underlying economic principles, commercial foundations and market analysis. Unlike technical analysis, which focuses on trends and standards, fundamental evaluation considers all relevant factors that can affect the price of a cryptocurrency.

Why is fundamental evaluation important?

- Understand market feeling : By analyzing the fundamental aspects of a cryptocurrency, investors can evaluate market feeling, identifying possible areas of conditions on super sold or excessive sales.

- Identifying investment opportunities : Fundamental assessment helps identify undervalued cryptocurrencies with strong growth potential, as well as warning against overvalued that can be due by correction.

- Protect against speculation : By understanding underlying grounds, investors can make more informed decisions and avoid speculation -oriented investments that can lead to significant losses.

Factors -chave to be considered

- Business Model : Revenue, profitability and scalability flows of a cryptocurrency are crucial factors to determine their value. For example, a decentralized change (DEX) like Uniswap can be more valuable than a traditional centralized exchange.

- A large market value may indicate a strong demand for a particular token.

3.

4.

- Network Effects

: Cryptocurrencies with strong network effects, where users are more likely to maintain and participate in the ecosystem, tend to increase in value over time.

Successful Fundamental Evaluation Examples

- Bitcoin : Despite its volatility, Bitcoin is often considered a stable storage of value due to its limited supply (21 million), widespread adoption (more than 50% of global transactions) and strong effects of the network.

- Ethereum : As the largest intelligent contract platform, Ethereum’s fundamental assessment is driven by its growing ecosystem, scalability improvements and increased adoption in space defi.

- Cardano : With a strong focus on scalability, safety and developer adoption, the fundamental assessment of cardano has constantly increasing over time.

Challenges in the fundamental evaluation

- Lack of transparency : Cryptocurrencies generally lack transparent financial statements or audited accounting, making it difficult to evaluate their value.

- Misleading marketing : Some cryptocurrencies are strongly marketed with exaggerated claims or promises that may not be supported by reality.

3.

Conclusion

Fundamental assessment is a crucial aspect of investment in cryptocurrencies, providing investors a clear understanding of the underlying economic principles and commercial foundations that drive the value of an active in particular.

Leave Your Comment