The Rise and Fall of Ethereum: A Catalyst for the Fall

In early January 2015, the cryptocurrency market experienced a sudden and significant decline, with Bitcoin (BTC) losing approximately 80% of its value in less than a month. This phenomenon left many wondering what led to such a drastic price drop. To delve into the reasons for this massive decline, let’s take a look at the key factors that contributed to Bitcoin’s loss of value.

The Rise of Ethereum: A Catalyst for the Fall

As we know, Bitcoin was launched in 2009 by an anonymous individual or group using the pseudonym Satoshi Nakamoto. Its initial success was largely due to its innovative technology that introduced a decentralized and trusted system for secure electronic transactions. However, as time went on, Bitcoin faced increasing competition from other cryptocurrencies that offered similar features at a lower cost.

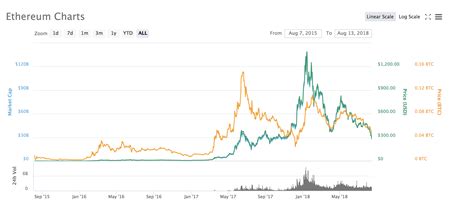

Ethereum (ETH), launched in 2015 by Vitalik Buterin, is often credited with disrupting the traditional blockchain. Ethereum’s smart contract platform allowed developers to create decentralized applications (dApps) without the need for a central authority or intermediaries. This created a new paradigm for secure and efficient transaction processing.

The Rise of Ethereum: A Catalyst for the Fall

However, it was not just the introduction of Ethereum that led to Bitcoin’s downfall. The two cryptocurrencies had different market structures and use cases. Bitcoin’s price was heavily influenced by its limited supply (only 21 million coins) and its acceptance as a store of value and medium of exchange.

Ethereum, on the other hand, gained traction primarily due to its growing ecosystem of decentralized applications, which attracted new users and developers. Ethereum’s smart contract platform allowed developers to create complex applications that could interact with each other in a decentralized manner, fostering a more open and interoperable ecosystem.

Price Drop: A Complex Interplay of Factors

So what led to Bitcoin’s rapid decline in value? Several factors contributed to this phenomenon:

- Saturation: As the Ethereum smart contract platform gained popularity, it attracted new users and developers who were drawn to its potential for building complex applications.

- Increased Competition: Other cryptocurrencies such as Litecoin (LTC), Dogecoin (DOGE), and Monero (XMR) entered the market, directly competing with Bitcoin for attention and adoption.

- Market Sentiment

: The rise of the Ethereum ecosystem led some investors to bet against Bitcoin, viewing it as less secure and more volatile due to its lack of decentralized application support.

- Liquidity Issues: As Bitcoin became more popular, liquidity in the market declined, making it difficult for traders to buy or sell the currency at competitive prices.

- Regulatory Uncertainty

: The increasing regulatory scrutiny of cryptocurrencies like Bitcoin has created a sense of uncertainty and volatility among investors.

What’s been driving the price of altcoins down lately?

The current decline in cryptocurrency prices can be attributed in part to several factors:

- Regulatory Uncertainty: As mentioned earlier, regulatory scrutiny has led to increased volatility and uncertainty among investors.

- Liquidity Issues: Reduced liquidity in the market has made it difficult for traders to buy or sell cryptocurrencies at competitive prices.

- Saturation: The rise of the Ethereum ecosystem has led to increased competition for attention and adoption, which can lead to reduced demand and lower prices.

- Market Sentiment: Bitcoin’s decline in value was partly due to investors betting against the currency, perceiving it as less secure and more volatile due to its lack of decentralized application support.

Leave Your Comment